The 2025 Tax Reform included amendments to the Consumption Tax Act. This bulletin introduces revisions to the tax-free shopping system for foreign tourists and tax-free shops.

1. Overview

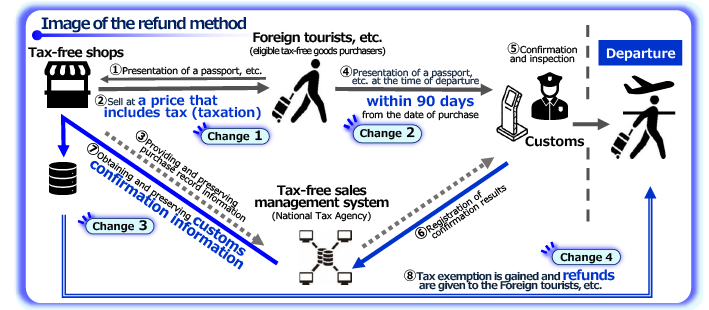

To address abuses such as the domestic diversion of tax-free purchases, the system will be revised to a refund method where the consumption tax is reimbursed after it has been confirmed that the goods have left Japan. The new system will begin operation on November 1, 2026.

Under the refund method, the requirements will be revised from the perspective of reducing administrative burdens on tax-free shops and improving convenience for foreign travelers.

2. Details of the revision

1) The Tax-Free Shopping System will be changed to the “refund method” whereby tax-free sales are finalized upon confirmation that tax-free goods are taken out of the country. Specifically, when a business operator that manages an export tax-free shop, sells tax-free goods to a tax-free goods purchaser, consumption tax will be charged on the sale initially. The tax will only be refunded to the purchaser after the Director of Customs confirms to the business operator that the purchaser has exported the relevant tax-free goods within 90 days of the date of the tax-free purchase. This confirmation will be provided through verification of the goods upon departure from Japan. The business operator can either make the refund themselves or entrust it to an approved tax-free procedure business operator. An outline of the process can be found in the Annex.

2) When the Director of Customs conducts verification, customs verification information is to be provided to the business operator managing the tax-free shop through the Director of National Tax Agency. It was stipulated that the tax-free treatment would not apply unless the business operator retains such customs verification information.

3) Tax-free goods purchasers who have received confirmation from the Director of Customs, are obligated to export the confirmed tax-free goods without delay. Should such tax-free goods not be exported, the Director of Customs shall immediately collect consumption tax equivalent to the amount of consumption tax exempted for those goods from the confirmed tax-free goods purchaser. Furthermore, a tax-free goods purchaser who fails to export the tax-free goods without justifiable reason shall be subject to penalties.

4) The category distinction between general goods and consumable products, along with the daily purchase limit per store for consumable products (JPY 500,000 excluding tax), has been abolished. The requirement for special packaging concerning consumable products has also been abolished. Furthermore, the requirement to determine whether the tax-free goods are for daily use has been abolished. Instead, goods such as gold bullion, which carry a high risk of being purchased for fraudulent purposes, will be individually designated as items excluded from tax-free goods.

5) Persons who stay in Japan under landing permits for cruise ship tourists will be required to present their landing permits and passports to the operator of the tax-free shop when making tax-free purchases.

6) For tax-free items with a tax-excluded value of JPY 1 million or more, it has been determined that purchase record information must include details sufficient to identify the specific tax-free item upon confirmation by the Director of Customs.

7) As for the requirement for tax-free shops, the distinction between the category of Tax-free shop (general type) and Tax-free shop (procedure entrustment type) will be integrated into Tax-free shop (general type). After the integration, a business operator that manages a general tax-free shop may entrust the affairs related to the tax-free sales procedure to an approved tax-free procedure business operator, and in this case, the requirement (location of the tax-free procedure counter) to be within a “specified commercial facility” under the current system will no longer be mandatory. However, the tax-free sales procedure must be conducted on the same day that the eligible goods are sold at the tax-free shop.

Annex

Source:

National Tax Agency, “Tax-Free Shopping System will be shifted to the Refund Method from November 2026”, accessed December 2, 2025

税務・会計・監査・アドバイザリーに関わる最新のニュースをお届けします。