The corporations subject to the size-based business taxation have been revised with the 2024 (Reiwa 6) tax reform. As for the 2024 (Reiwa 6) tax reform and applicable corporations, please refer to the August 2024 Japan Tax Bulletin “Tax reform on the sized-based business taxation”. This section outlines the calculation method for the size-based business taxation.

1. Overview

The size-based business taxation system is a type of business tax and imposes “a value-added tax” and “a capital-based tax” on corporations such as ones with stated capital of more than JPY100 million, in addition to an income-based tax. The taxes are levied even where a corporation is in currently loss position. A value-added tax is levied based on the sum of the distribution of earnings (comprising remuneration and salaries, net interest paid and net rent paid) and taxable income or loss for a single year, and a capital-based tax is levied based on the amount of stated capital, capital reserve, other capital surplus etc. as defined by the local tax law.

2. Value-added tax

The taxable base for value-added tax is calculated as follows;

1) Remuneration and salaries

This is total of the following amounts. All expenses and revenues must be allowable under the corporate tax law. Expenses and revenues not allowed under the corporate tax law are excluded.

(i) Salary, remuneration, wages, bonuses, retirement allowances and expenses of a similar nature paid to employees and also officers. Taxable fringe benefits are also included except non-taxable income under the income tax law such as commutation allowances under a certain level.

* For ones related to dispatched workers, refer to (iii)

(ii) Contributions made by an employer to corporate pension plans or defined contribution pension plans etc. for its employees and officers.

(iii) Dispatch contract fees

(a) In the case of receiving dispatched workers

75% of dispatch contract fees based on individual worker dispatch contracts pursuant to Article 26 of the Worker Dispatch Law (hereinafter “dispatch contract fees”).

(b) In the case of sending dispatched workers

The amount obtained by subtracting 75% of dispatch contract fees from salaries etc. described in (i) above paid to the dispatched workers for work at the dispatched work assignment location.

* If the amount is negative, it is treated as zero.

2) Net interest paid

This amount is the one obtained by subtracting (i) from (ii) below. If the amount is negative, it is treated as zero.

(i) Tax-deductible interest paid such as interest on loans, bonds, discount expense of bills, and other interest of a similar nature. It also includes delinquent tax with a nature of interest.

(ii) Taxable interest received such as interest on bank deposits, loans, bonds, and other interest of a similar nature. It also includes interest on tax refund.

3) Net rent paid

This amount is the one obtained by subtracting (i) from (ii) below. If the amount is negative, it is treated as zero.

(i) Tax-deductible rent paid such as lease fees for land, buildings, equipment attached to buildings and storage, where the lease term is longer than one month. It doesn’t include lease fees for machinery and motor vehicles.

(ii) Taxable rent received such as lease fees for land, buildings, equipment attached to buildings and storage, where the lease term is longer than one month. It doesn’t include lease fees for machinery and motor vehicles.

4) Employment stability deduction

If the 1) Remuneration and salaries amount exceeds 70% of the distribution of earnings*, the certain amount is deducted from the taxable base for the value-added tax. Also, in addition to the employment stability deduction, if the tax credit for salary increase is applied under the corporate tax law, the certain amount is deducted from the taxable base for the value-added tax.

*The distribution of earnings is the total of 1) Remuneration and salaries through 3) Net rent paid.

5) Taxable income or loss for a single year

This amount is taxable income or taxable loss for the applicable fiscal year. In the case of taxable income, it is the amount before the use of carried-forward losses. If the taxable loss exceeds the distribution of earnings, the taxable base for the value-added tax is zero.

3. Capital-based tax

The taxable base for capital-based tax is, in principle, the total amount of stated capital, capital reserve and other capital surplus etc. as of the fiscal year end under the corporate tax law (hereinafter referred to as “stated capital etc.”). In the event of a capital increase or decrease without consideration, the amount is the one calculated by making certain adjustments to the stated capital etc. If the stated capital etc. is less than the total of stated capital and capital reserve for accounting purpose in that case, the amount is the total of stated capital and capital reserve for accounting purpose.

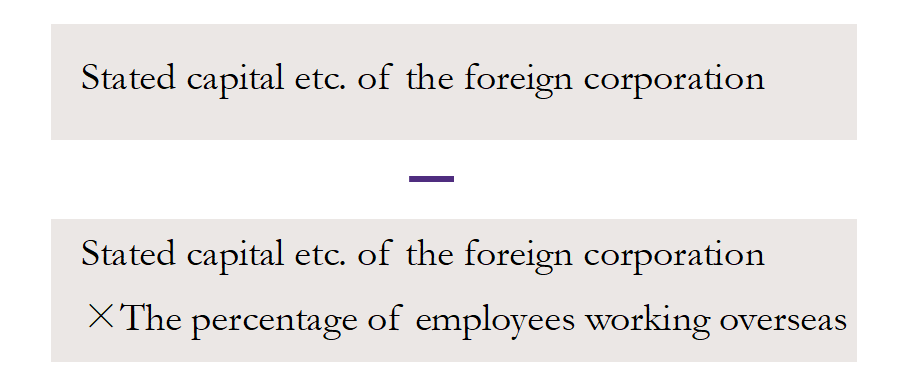

In the case of foreign corporations, it is calculated as follows;

4. Tax rate

For corporations in Tokyo with fiscal years beginning on or after April 1, 2022, the value-added tax rate is 1.26% and the capital tax rate is 0.525%.

* In addition, income-based tax based on taxable income is also levied like corporations that are not subject to the size-based business taxation system.

* The income-based tax rate is 1.18% for corporations in Tokyo with fiscal years beginning on or after April 1, 2022.

税務・会計・監査・アドバイザリーに関わる最新のニュースをお届けします。