View as PDF

The global tax landscape is experiencing a historic transformation as countries implement the OECD/G20’s Pillar Two framework—an initiative designed to introduce a Global Minimum Tax (GMT) of 15% on large multinational enterprises (MNEs). Japan has taken a proactive role in adopting and legislating this framework, aligning its domestic laws with the OECD’s model rules while tailoring certain elements to suit its national tax policy objectives. This article provides an overview of the Income Inclusion Rule (IIR), Undertaxed Profits Rule (UTPR), and Qualified Domestic Minimum Top-up Tax (QDMTT) as implemented in Japan, highlights key dates, compares Japan’s approach with OECD recommendations, and explains the rules’ impact on Japanese corporations.

1. Overview of the Global Minimum Tax Rules

The Pillar Two framework established by the OECD/G20 Inclusive Framework is designed to address base erosion and profit shifting by ensuring that large multinational groups pay at least 15% in tax on the income they earn in every jurisdiction where they operate.

The rules apply to MNEs with consolidated group revenue of EUR 750 million or more, and are composed of three primary mechanisms:

- Income Inclusion Rule (IIR)

- Undertaxed Profits Rule (UTPR)

- Qualified Domestic Minimum Top-up Tax (QDMTT)

These mechanisms work together to reduce the incentive for profit shifting and tax competition.

2. Japan’s Legislative Timeline and Key Features

| Rule | Japanese Legislative Implementation | Effective for Fiscal Years Beginning on or After |

|---|---|---|

|

IIR

|

2023 Tax Reform (Reiwa 5) [1]

|

April 1, 2024

|

|

UTPR

|

2025 Tax Reform (Reiwa 7) [2]

|

April 1, 2026

|

|

QDMTT

|

2025 Tax Reform (Reiwa 7) [2]

|

April 1, 2026

|

[1] Japan legislated the IIR as part of its 2023 tax reform

[2] In the 2025 tax reform, Japan added the UTPR and QDMTT, in response to OECD’s model rules and guidance.

3. Understanding the Rules: OECD Model vs. Japan's Implementation

1) Income Inclusion Rule (IIR)

The IIR is the primary rule under Pillar Two of the OECD/G20 Base Erosion and Profit Shifting (BEPS) 2.0 project. It requires a parent entity to pay a top-up tax if its subsidiaries located in low-tax jurisdictions (i.e., with an effective tax rate below 15%) do not meet the minimum threshold. The parent must calculate and pay the difference between the actual tax paid and the 15% minimum.

Japan enacted the IIR rule in its 2023 Tax Reform Law (effective from fiscal years beginning on or after April 1, 2024). The legislation introduced the concept of the "International Minimum Tax Amount" into the Japanese Corporate Tax Act. Japanese parent companies are required to calculate top-up taxes if any of their foreign subsidiaries are insufficiently taxed.

2) Undertaxed Profits Rule (UTPR)

The UTPR is a secondary, backstop mechanism that applies when the IIR cannot be fully applied. It ensures that untaxed profits in low-tax jurisdictions are allocated to entities in jurisdictions applying the UTPR, even if those entities are not the parent. The UTPR works by denying deductions or making equivalent adjustments to increase taxable income in compliant jurisdictions.

Japan included UTPR in the 2025 tax reform package, with application starting from fiscal years beginning on or after April 1, 2026. Under the proposed Japanese rules, where IIR cannot collect the full amount of top-up tax (e.g., if the parent is located in a non-cooperative low-tax country), Japanese subsidiaries may be required to pay the remaining top-up tax.

3) Qualified Domestic Minimum Top-up Tax (QDMTT)

The QDMTT is an optional rule allowing a jurisdiction to impose a domestic top-up tax on local entities when their effective tax rate falls below 15%. The purpose is to allow jurisdictions to retain taxing rights over low-taxed income instead of ceding them to foreign IIR/UTPR jurisdictions.

Japan opted to implement QDMTT through the 2025 tax reform, effective April 1, 2026, to defend its domestic tax base and reduce exposure to foreign IIR or UTPR claims. If a Japanese corporation’s effective tax rate is below 15%, the QDMTT ensures the top-up tax is levied within Japan.

| Rule | OECD Feature | Japan’s Implementation |

|---|---|---|

|

IIR |

Primary top-up mechanism for parent entities |

Closely aligned, no major deviation |

|

UTPR |

Secondary rule if IIR cannot apply |

Simpler enforcement model, Japan uses direct taxation over denial-of-deduction |

|

QDMTT |

Optional domestic rule to prevent foreign taxation |

Strong local safeguard, given priority over IIR/UTPR; structured to protect Japan tax base |

4. Illustration of Rule Application in Japan

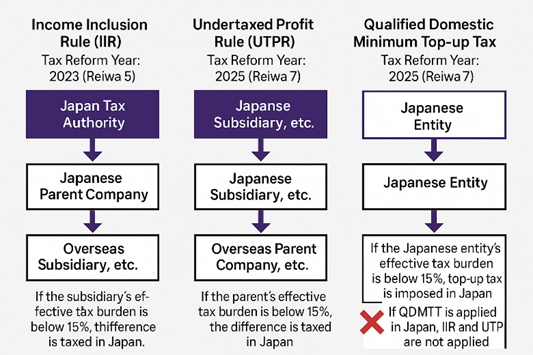

Above is a simplified representation of how these rules apply to Japanese corporations:

- Left (IIR):

Japan taxes Japanese parent on under-taxed income of overseas subsidiaries. - Center (UTPR):

Japan taxes Japanese subsidiary for income insufficiently taxed at the foreign parent level. - Right (QDMTT):

Japan imposes top-up tax locally if the Japanese entity’s effective tax rate falls below 15%. When QDMTT applies, foreign IIR/UTPR rules do not.

1) Practical Implications for Japanese Corporations

Japanese corporations, especially those that are part of large multinational groups, will need to take concrete steps to address these developments:

- Compliance and Reporting

- Prepare for GloBE-compliant documentation.

- Develop systems to calculate effective tax rates by jurisdiction.

- Monitor changes in OECD guidance and Japanese tax law.

- Strategic Tax Planning

- Evaluate group structures, especially involving entities in low-tax jurisdictions.

- Assess whether QDMTT can be used to mitigate IIR/UTPR exposure.

- System and Process Updates

- Implement new tax data systems or update ERP platforms to enable jurisdiction-level computations.

- Align tax risk management frameworks with minimum tax rules.

5. Conclusion

Japan's careful and phased implementation of the Global Minimum Tax rules demonstrates its commitment to international tax reform while preserving domestic taxing rights. By introducing QDMTT alongside IIR and UTPR, Japan has not only aligned with OECD expectations but has also created mechanisms to protect its own corporate tax base.

With IIR now in effect and the remaining rules to follow in 2026, Japanese companies must act swiftly to ensure readiness. The road to minimum taxation compliance is complex, but with proactive planning and robust systems, businesses can minimize risk and stay ahead of global tax change.

If you are interested in receiving our latest insights, You can sign up to our mailing list.