-

Statutory audits

As a member firm of Grant Thornton International (GTIL), we provide international-standard audit & assurance services. We perform audit services effectively and efficiently by utilising our global audit methodologyo deliver consistent audit services globally and the integrated audit tool (Leap) to maintain audit quality and improve audit efficiency. Also our audit services are regularly reviewed by GTIL review team, thereby allowing us to further improve our audit quality.

-

IPO voluntary audits

Grant Thornton Taiyo LLC provides audits for preparing for public offering, based on its extensive experience, to many companies aiming to go public.

-

Other voluntary audits

Grant Thornton Taiyo LLC provides various types of discretionary audits based on the request of management.

-

Information security audit

We verify and evaluate the state of appropriate controls based on information security risk assessments, and provide accurate advice to help improve information security.

-

Business Tax Services

Growing businesses need strong tax management to meet current and future tax liabilities and we can help you achieve this, whatever challenges you face.

-

Private Client Consulting

Private Client Consulting team provides a comprehensive cross section of advisory services to high net worth individuals and corporate executives, allowing such individuals to concentrate on their business interests.

-

International Tax Services

In an ever-increasing environment of global competition, businesses must now cope with not only the complexity of different global operating environments, but also with global tax, legislative and corporate regulatory requirements.

-

Transaction Tax

Our collaborative approach creates dynamic teams with a range of financial, commercial and operational backgrounds. We can help you understand the value drivers behind successful transactions. We support you throughout the transaction process helping achieve the best possible outcome at the point of the transaction and in the longer term.

-

Human Capital

With expertise in visa, payroll, human capital and income tax, we adopt a multi-disciplinary and global approach to provide comprehensive solutions to businesses' most valuable asset-people.

-

Corporate Finance

Growing your business profitably against a tough economic backdrop is challenging and correctly evaluating and delivering transactions is a key part of a company’s growth strategy.

-

IPO Consulting

From business incubation to public stock offering, we offer a wide range of support programsservices for every stage of business development.

-

International financial reporting standards (IFRS)

Our IFRS advisers can help you navigate the complexity of the Standards so you can focus your time and effort on running your business.

-

Reorganizations

Grant Thornton Taiyo Inc. provides total support for corporate restructuring; aimed atto responding to dramatic changes in the management environment.

-

Corporate governance and risk management

Helping you balance risk and opportunity

-

Forensic and investigation services

Rapid and customised approach to investigations and dispute resolution

-

Market research

Growing your business profitably against a tough economic backdrop is challenging and correctly evaluating and delivering transactions is a key part of a company’s growth strategy.

-

Strategy

We can support you throughout the transaction process – helping achieve the best possible outcome at the point of the transaction and in the longer term..

-

China Business and Tax Advisory Services

We take the worry out of doing business in China, working closely with Grant Thornton member firms and other professional accounting firms in China.

-

Business Process Re-engineering

Growing your business profitably against a tough economic backdrop is challenging and correctly evaluating and delivering transactions is a key part of a company’s growth strategy.

オプション性を有する金融資産及び金融負債の価値算定を支援します。

■支援対象範囲及び対応可能な評価手法

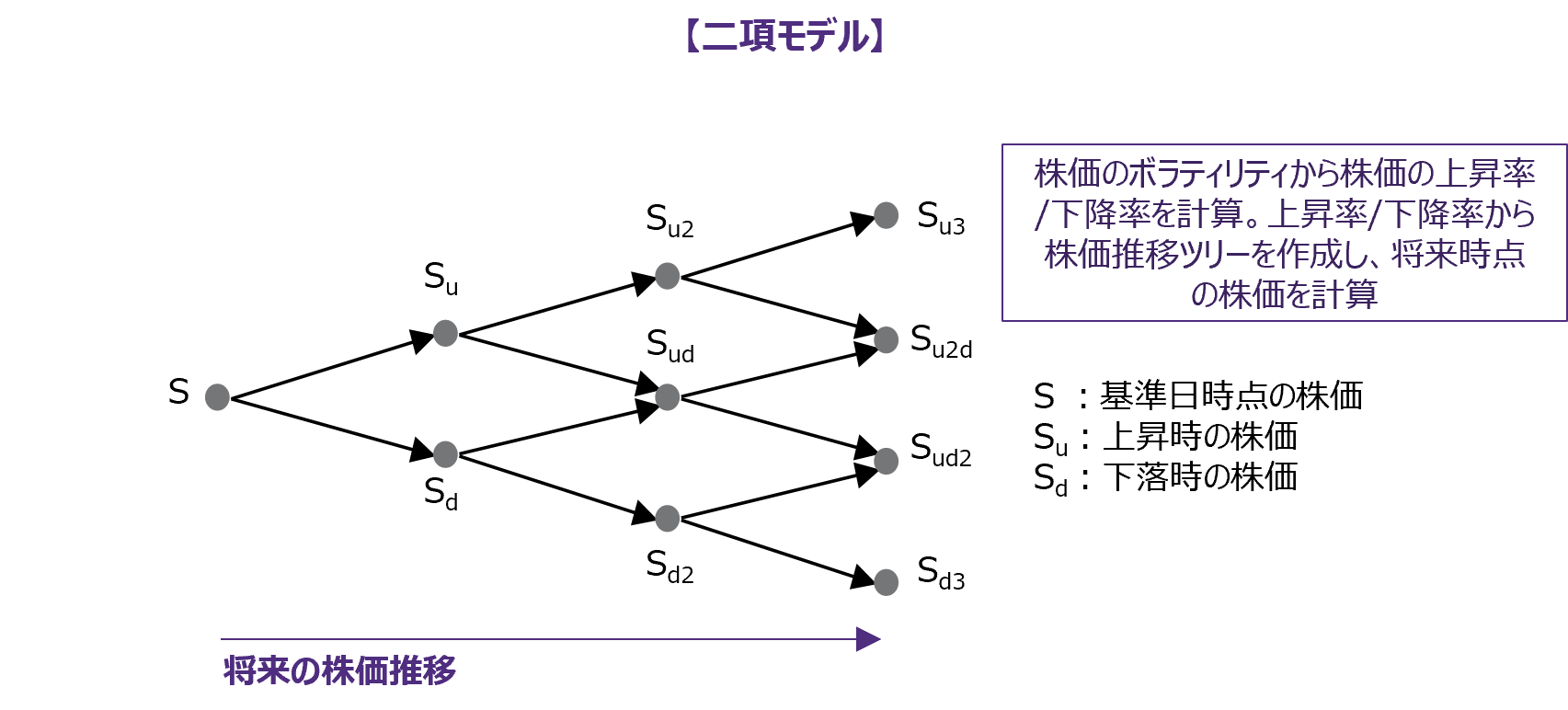

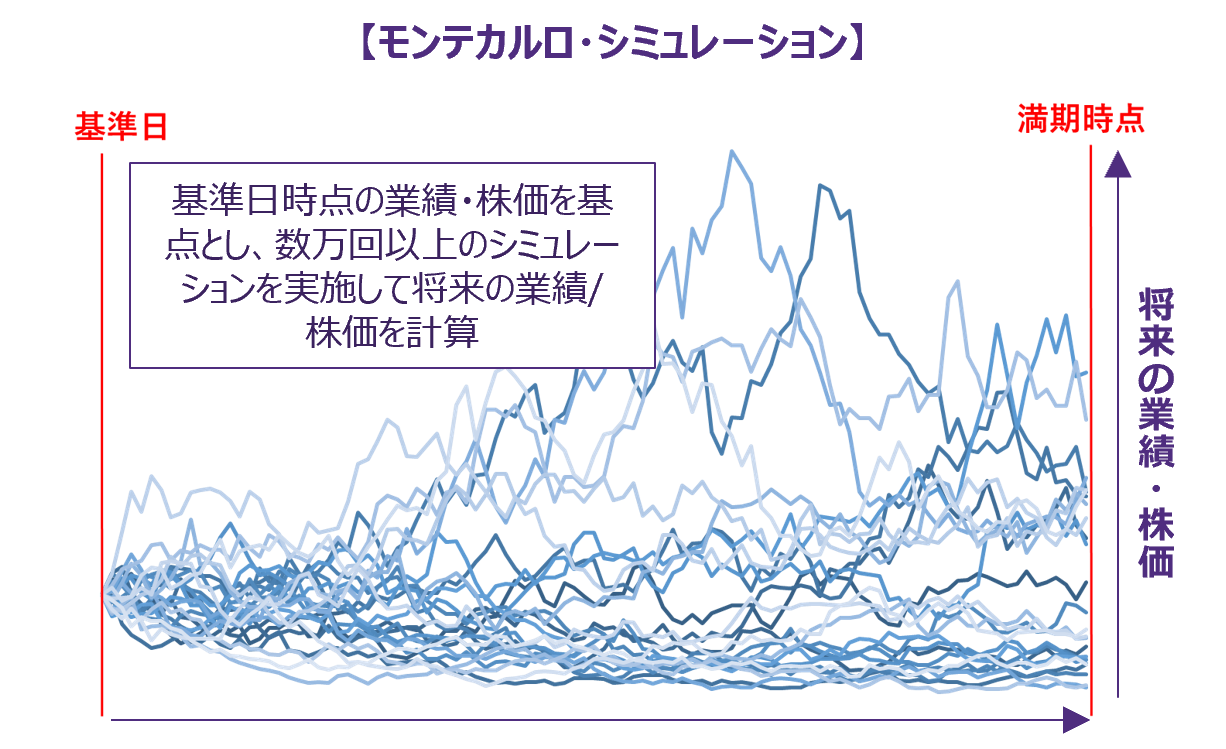

アーン・アウト(条件付き対価)、種類株式、新株予約権、転換社債型新株予約権付社債(以下、「転換社債」)に係る会計処理目的の時価(公正価値)評価を支援します。弊社は、オプション性を有する金融資産及び負債の評価において一般的に用いられる全ての評価手法(ブラックショールズモデル(以下、「BSモデル」)、二項モデル、モンテカルロ・シミュレーション)による算定が可能です。

アーン・アウト(条件付き対価)の公正価値評価

IFRS3号にて規定されている「条件付き対価」に該当するアーン・アウトは、企業結合日時点における公正価値を測定し、取得対価の一部として認識して会計処理を実施することが求められます。また、アーン・アウトはそのペイオフの特性に応じて評価モデルを選定し、モデル構築する必要があります。弊社は経路依存型のペイオフの特性(複数回の業績判定、アーンアウト額の上限値-下限値、権利確定・権利失効等)及び複数の業績条件の判定を織り込んだモンテカルロ・シミュレーションによる評価が可能です。また、アーン・アウトの条件交渉に向けての事前検討シミュレーションも支援します。

種類株式の時価(公正価値)評価

種類株式評価では、種類株式に付されている経済的に有利な権利条件(みなし清算条項に基づく優先残余財産分配権、普通株式を対価する取得請求権、金銭対価の取得請求権、累積型優先配当権)を考慮し、適切な評価手法を選定して評価する必要があります。弊社はこれらの経済的に有利な権利条件を評価に織り込むために一般的に用られるオプション価格法、現状価値法、ハイブリット法での評価が可能です。

新株予約権の時価(公正価値)評価

新株予約権評価において一般的に用いられるBSモデル、二項モデルでの評価が可能です。さらにIFRSの公正価値測定で織り込む必要がある株式市場条件(株価推移に基づく権利確定・権利失効、マーケット・インパクト、権利行使価格修正条項等)をモンテカルロ・シミュレーションに織り込んでの評価が可能です。

転換社債の時価(公正価値)評価

転換社債の評価では、社債として継続保有して受取れるペイオフと、株式に転換して受取れるペイオフの大小関係を各時点で比較して、株式転換または継続保有のオプション性を評価に反映する必要があります。弊社は当該オプション性を評価に反映するため、一般的に用られる二項モデルでの評価が可能です。