-

Statutory audits

As a member firm of Grant Thornton International (GTIL), we provide international-standard audit & assurance services. We perform audit services effectively and efficiently by utilising our global audit methodologyo deliver consistent audit services globally and the integrated audit tool (Leap) to maintain audit quality and improve audit efficiency. Also our audit services are regularly reviewed by GTIL review team, thereby allowing us to further improve our audit quality.

-

IPO voluntary audits

Grant Thornton Taiyo LLC provides audits for preparing for public offering, based on its extensive experience, to many companies aiming to go public.

-

Other voluntary audits

Grant Thornton Taiyo LLC provides various types of discretionary audits based on the request of management.

-

Information security audit

We verify and evaluate the state of appropriate controls based on information security risk assessments, and provide accurate advice to help improve information security.

-

Business Tax Services

Growing businesses need strong tax management to meet current and future tax liabilities and we can help you achieve this, whatever challenges you face.

-

Private Client Consulting

Private Client Consulting team provides a comprehensive cross section of advisory services to high net worth individuals and corporate executives, allowing such individuals to concentrate on their business interests.

-

International Tax Services

In an ever-increasing environment of global competition, businesses must now cope with not only the complexity of different global operating environments, but also with global tax, legislative and corporate regulatory requirements.

-

Transaction Tax

Our collaborative approach creates dynamic teams with a range of financial, commercial and operational backgrounds. We can help you understand the value drivers behind successful transactions. We support you throughout the transaction process helping achieve the best possible outcome at the point of the transaction and in the longer term.

-

Human Capital

With expertise in visa, payroll, human capital and income tax, we adopt a multi-disciplinary and global approach to provide comprehensive solutions to businesses' most valuable asset-people.

-

Corporate Finance

Growing your business profitably against a tough economic backdrop is challenging and correctly evaluating and delivering transactions is a key part of a company’s growth strategy.

-

IPO Consulting

From business incubation to public stock offering, we offer a wide range of support programsservices for every stage of business development.

-

International financial reporting standards (IFRS)

Our IFRS advisers can help you navigate the complexity of the Standards so you can focus your time and effort on running your business.

-

Reorganizations

Grant Thornton Taiyo Inc. provides total support for corporate restructuring; aimed atto responding to dramatic changes in the management environment.

-

Corporate governance and risk management

Helping you balance risk and opportunity

-

Forensic and investigation services

Rapid and customised approach to investigations and dispute resolution

-

Market research

Growing your business profitably against a tough economic backdrop is challenging and correctly evaluating and delivering transactions is a key part of a company’s growth strategy.

-

Strategy

We can support you throughout the transaction process – helping achieve the best possible outcome at the point of the transaction and in the longer term..

-

China Business and Tax Advisory Services

We take the worry out of doing business in China, working closely with Grant Thornton member firms and other professional accounting firms in China.

-

Business Process Re-engineering

Growing your business profitably against a tough economic backdrop is challenging and correctly evaluating and delivering transactions is a key part of a company’s growth strategy.

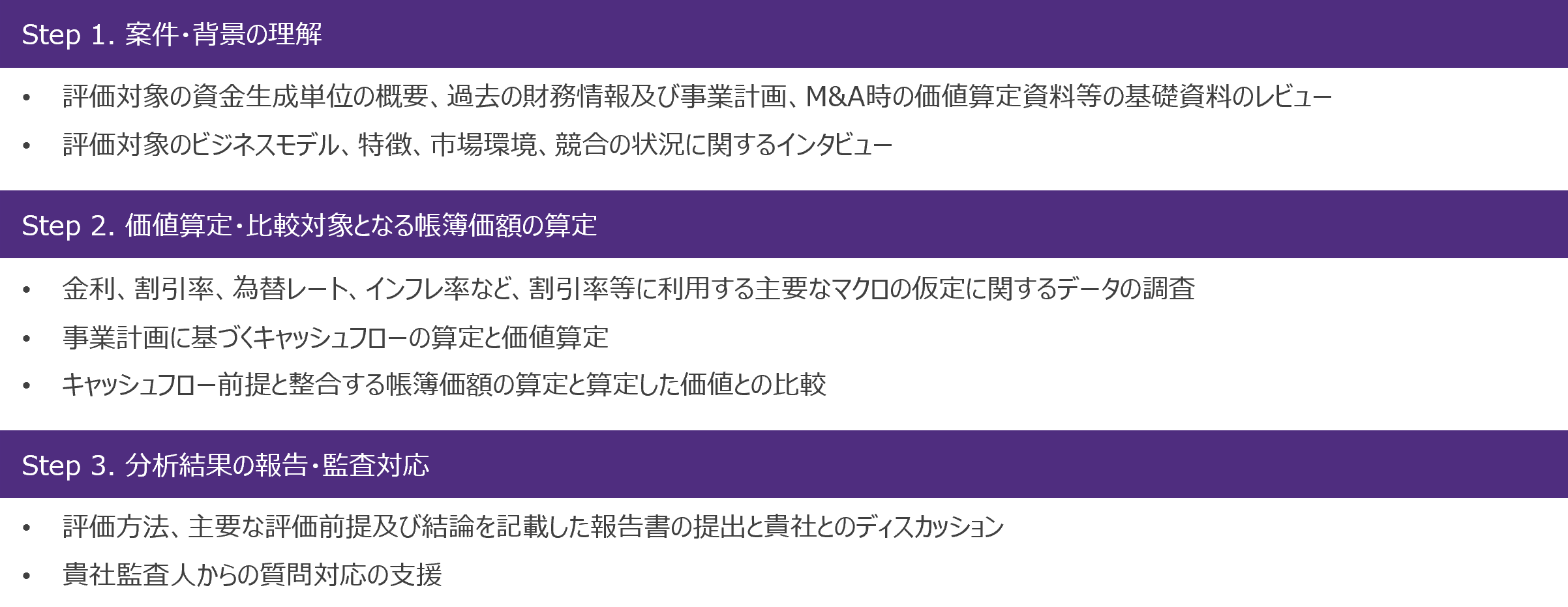

事業価値算定と会計監査に精通した公認会計士等が減損テストにおける価値算定を実施し、減損に関する監査の完了まで支援します。

のれんの減損テスト

国際財務報告基準(IFRS)では、のれんが含まれる資金生成単位や耐用年数が確定できない無形資産等については、減損の兆候の有無にかかわらず毎期、減損テストの実施が必要となります。M&Aではのれんが発生することが多いことから、IFRS採用企業がM&Aにより企業または事業を取得した場合、多くのケースにおいて毎期の減損テストの実施が必要となります。

また、IFRSとはアプローチは異なりますが、米国会計基準や日本基準においても減損テスト(減損の測定)は求められています。

減損損失の計上

減損テストの結果、資産の帳簿価額が回収可能価額を下回る場合には、両者の差額を減損損失として認識しなければなりません。ここで、回収可能価額とは、「使用価値」と「処分費用控除後の公正価値」のいずれか大きい方の額をいいます。

使用価値:経営者が意図する方法で資産を使用した場合の、将来のキャッシュフローの現在価値

処分費用控除後の公正価値:経営者の意図に関わらず、市場参加者が想定する効果的な使用方法に基づく価値から資産の処分費用を控除した額

のれんの減損損失は多額になるケースが多いことから、使用価値または処分費用控除後の公正価値の算定は、特に重要な検討事項になります。

当社のアプローチ

使用価値や処分費用控除後の公正価値の算定におけるキャッシュフローや割引率及び比較対象となる帳簿価額は、会計基準の規定や両者の整合性を満たすように算定する必要があります。それに加え、リスクや市況などを考慮した判断も必要となるため、高い専門性や知識・経験が要求されます。

弊社では、価値評価やファイナンス、会計基準、会計監査に関する豊富な知識と経験を有した専門チームが、貴社の事業計画や方針を尊重しながら、予備的な減損検討を含め、状況に合わせて最善のサービスを提供します。

また、のれんの減損のみならず、機械設備、不動産等の価値算定についても支援します。