Pillar Two presents a complex web of rules, Income Inclusion Rule (IIR), Qualified Domestic Minimum Top-up Tax (QDMTT), and the Undertaxed Profits Rules (UTPR), formerly known as the Undertaxed Payments Rule. Multinational enterprises (MNEs) operating in Japan will need to understand the interaction of each rule enacted under Japan's domestic legislation.

Japan enacted UTPR and QDMTT under its 2025 tax reform, effective for fiscal years beginning on or after April 1, 2026. The IIR, enacted in Japan in 2023, takes priority over the UTPR for Japan-headquartered MNEs with low-taxed constituent entities (LTCEs). On the other hand, for inbound companies, which are foreign-headquartered MNEs with operations in Japan, UTPR would be relevant for them if their ultimate parent entity (UPE) jurisdiction does not have a fully functioning IIR. It should be noted that Japan UTPR will be applicable to foreign companies that have a Permanent Establishment (PE) in Japan and joint ventures.

To the extent the Japan constituent entity (CE) does not own any foreign subsidiaries or branches, which is often the case for many inbound MNEs’ corporate structures in Japan, Japan IIR will not apply to that Japan CE.

With Japan being a high tax jurisdiction, QDMTT is often seen as a minor risk for MNE groups operating in Japan unless they enjoy significant tax incentives or tax credits here. On the other hand, UTPR, unlike the QDMTT, does not depend on the entity’s profit in its resident jurisdiction, but rather on the top-up tax payable due by the UPE or group entities. In other words, UTPR top-up tax is due in jurisdictions that are different from those in which the regular corporate income tax or QDMTT is due. For inbound companies in Japan, this means that if other entities within their MNE groups are subject to low taxation in other jurisdictions, their Japan operations could unexpectedly face an increased tax burden through the UTPR.

1. How the UTPR Mechanism Works:

The UTPR acts as a backstop to the IIR, the primary component of Pillar Two. The IIR allows the jurisdiction of the UPE to impose a top-up tax on LTCEs within an MNE group. However, the UTPR steps in when the UPE jurisdiction has not implemented a qualifying IIR or when the IIR has not fully collected the top-up tax. In such scenarios, the UTPR allows other jurisdictions where the MNE group has entities to allocate and collect this residual top-up tax.

When a CE within an MNE group has an effective tax rate (ETR) below 15% in a particular jurisdiction, and the UPE jurisdiction hasn't fully collected the top-up tax under the IIR, the UTPR mechanism kicks in. This mechanism essentially imposes equivalent adjustments in UTPR jurisdictions to collect an amount of tax proportionate to the undertaxed profits in the low-tax jurisdiction and the level of substance in the UTPR jurisdiction.

Under the Model Rules, jurisdictions have a choice of either a denial of a deduction or other equivalent adjustments to collect the tax. Japan has chosen the option of imposing an equivalent amount of top-up tax amount that is not subject to a qualified IIR to be the UTPR tax payable.

Steps for calculating UTPR top-up tax amount payable for each Japan CE consist of the following:

- Determine the total top-up tax for each LTCE that is not subject to a qualified IIR.

- Sum the total top-up tax amounts for all LTCEs calculated in 1).

- Allocate the total UTPR top-up tax to each UTPR jurisdiction on the basis of a substance-based allocation key.

- Allocate the total UTPR top-up tax to each Japan CE using the same substance-based allocation key as in 3).

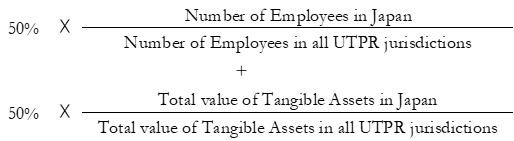

The substance-based allocation keys for allocation of the UTPR top-up tax are the number of employees and the value of tangible assets within each UTPR jurisdiction. Therefore, a significant presence in Japan in terms of employees and assets could lead to a larger share of the UTPR top-up tax being allocated to the Japan CEs.

The allocation methodology for the UTPR top-up tax payable amount within Japan (Step 4) is essentially the same as the allocation among UTPR jurisdictions (Step 3), except the number of employees and total value of tangible assets will be taken into account on an CE-by-CE basis in the numerator of the equation and the denominator will be the total of these in Japan.

2. UTPR Exclusion – Transitional rule for MNEs during their “Initial Phase of International Activity”

Japan made available a UTPR rule to MNE groups that are in their “initial phase of their international activity” to have temporary relief from the UTPR top-up tax (as well as Japan QDMTT) for 5 years (Article 9.3 Model Rules), starting from when the MNE group first comes within the scope of the GloBE rules.

In many cases an MNE group may already be within the scope of the GloBE rules but a domestic legislation may implement UTPR after IIR (thus creating a lag period), as is the case in Japan. Therefore, the five-year UTPR exclusion in Japan applies from the date the first UTPR law comes into effect internationally. The rationale is that at the time of the earliest IIR implementation in any country, the UTPR will not yet be in effect globally at that point. Therefore, instead of the five-year exclusion period starting from the earliest IIR implementation (and MNEs not benefiting from the exclusion during the lag period), the exclusion will apply after the earliest UTPR implementation.

To qualify for this UTPR exclusion rule, the MNE group must be in its initial phase of its international activity based on the following criteria:

- CEs in no more than six countries

- Net book value of tangible assets of all CEs (including stateless CEs) located in jurisdiction other than the reference jurisdiction less than or equal to 50M EUR

3. Navigating the Challenges:

Inbound companies will need to track potential UTPR liability and its impact on their Japan tax obligations. This increased data collection and analysis will likely necessitate significant investment in new systems and expertise. If other entities within the MNE group are low-taxed and the UPE jurisdiction doesn't fully implement the IIR, the Japan subsidiary or branch could see an increase in its tax liability through the UTPR mechanism. This will directly impact the profitability of their Japan operations and could affect investment decisions. Companies need to closely monitor the Pillar Two legislative developments in their UPE jurisdiction and other significant operational locations to anticipate potential UTPR implications in Japan. They should model how the UTPR allocation formula could impact their Japan tax liability under different scenarios.

4. Future of UTPR:

Controversies continue to surround the legality and taxing right of UTPR. Especially, the US believes that the UTPR is discriminatory and potentially constitutes an extraterritorial tax. As the UTPR is a supplementary tax measure that allows multiple subsidiaries’ countries to tax the shortfall when the ETR in the parent company's country is less than 15%, the UTPR does not require the nexus necessary for such taxation by those subsidiaries’ countries.

From the perspective of the US, which is home to large MNEs, the UTPR would create a mechanism for the US to cede the right to tax US MNEs to other countries. Recently the US government has warned the possibility of using Section 891 of the US Internal Revenue Code (IRC) to take retaliatory measures, such as doubling the tax rate within the US for companies from countries that impose discriminatory and extraterritorial taxes, like the UTPR.

There are also voices within the EU tax community calling for revisiting the implementation and application of UTPR, given its high complexity and the significant legal uncertainties it raises. In particular, there is concern about the aggressive application of the UTPR absent a global consensus, as this could invite retaliation and harm Europe's economic interests. Consequently, there is a push within the EU tax community for further reform of the UTPR.

Although there are uncertainties in the future of UTPR around the globe, Japan has enacted UTPR into law, and therefore compliance with Japan UTPR law is essential for MNEs operating in Japan. What inbound companies can do now is to understand the intricacies of UTPR, monitoring global Pillar Two implementation/reforms, and proactively assessing potential impacts. They are all essential steps for inbound companies to navigate the impact of UTPR and ensure compliance while safeguarding their profitability in the Japan market. Failure to do so could result in unexpected tax liabilities and an increased tax risk in Japan.

If you are interested in receiving our latest insights, You can sign up to our mailing list.