With the COVID-19 travel restrictions lifted, business travel has increased significantly. Some companies assume their employees are tax-exempt if their home country has an income tax treaty with the host country and the employee spends not more than 183 days in aggregate [1] there.

How to count the days can easily create confusion. This edition of the tax bulletin explains how to count 183 days and pitfalls you need to be aware of when counting travel days to Japan.

1. Overview

As of May 1, 2025, the government of Japan has a total of 87 tax conventions covering 156 tax jurisdictions [2]. Many treaties follow the OECD (Organization for Economic Co-operation and Development) Model Treaties. To claim relief from income tax, the following three conditions must be met:

- The recipient is present in the host country for a period or periods not exceeding in the aggregate 183 days in any 12-month period commencing or ending in the fiscal year concerned.

- The remuneration is paid by, or on behalf of, an employer who is not a resident of the host country.

- The remuneration is not borne by a permanent establishment which the employer has in the host country.

Please be advised that not every treaty convention follows the OECD model, and wording has been slightly adjusted. Thus, it is very important to check the actual treaty convention applicable to each case.

2. How to count 183 days

The number of days for tax treaty purposes can be determined based on the days physically present in Japan, either on a rolling 12-month period basis or on a calendar year basis.

For example, days are determined based on a rolling 12-month period basis for treaties with countries such as US, UK, Belgium, France, Australia, India, New Zealand, Netherlands, Singapore, Spain and other countries [3]. On the other hand, days are determined based a calendar year basis on treaties with countries such as Brazil, China, Canada, Indonesia, Italy, Israel, Malaysia, Poland, Vietnam and other countries [3].

For the purpose of counting days for the 183-day rule, both arrival and departure dates will be counted, even if the individual only spends part of the day in Japan, unless the stay in Japan is for transit purposes [4].

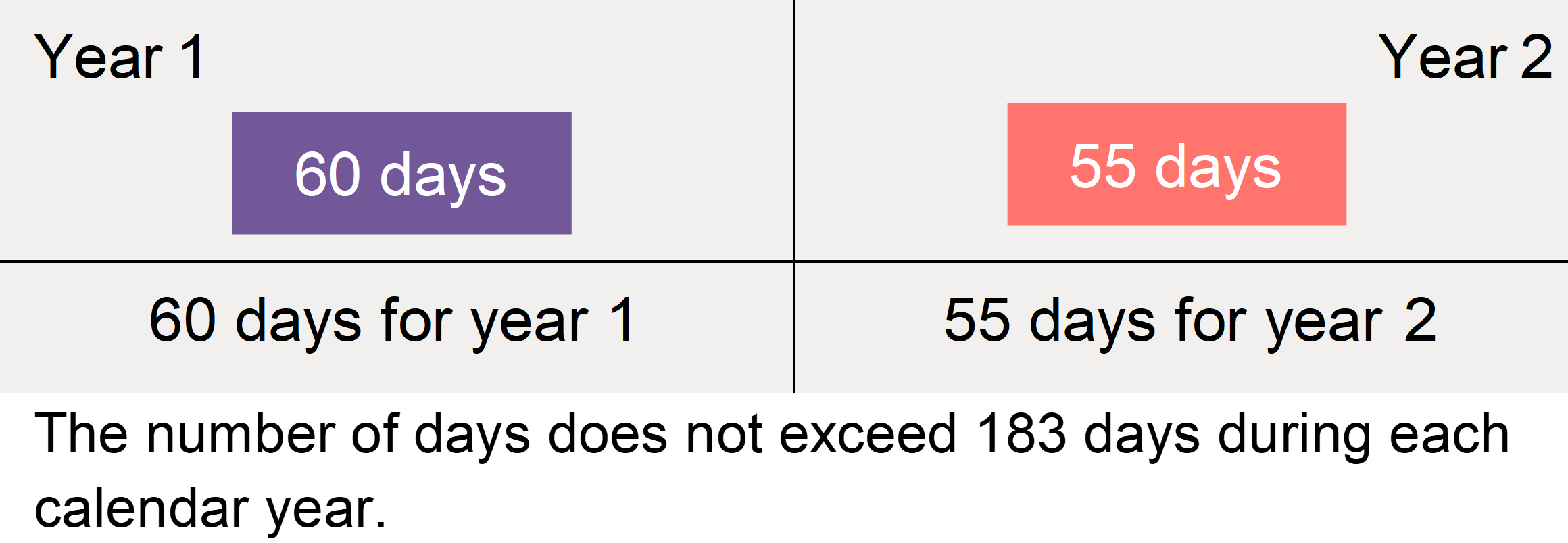

3. Example for Calendar Year/Tax Year Treaty

An employee of a Canadian company, who is a resident of Canada, travels to Japan for a 6-month project starting from October 1 of the current year. There is no travel outside of Japan during the project. Assuming each month consists of 30 days, under the calendar year basis, the employee is present in Japan for 60 days during year 1, and 55 days during year 2. Since the employee is present in Japan for not more than 183 days in aggregate for both year 1 and year 2, the employee meets the 183-day rule.

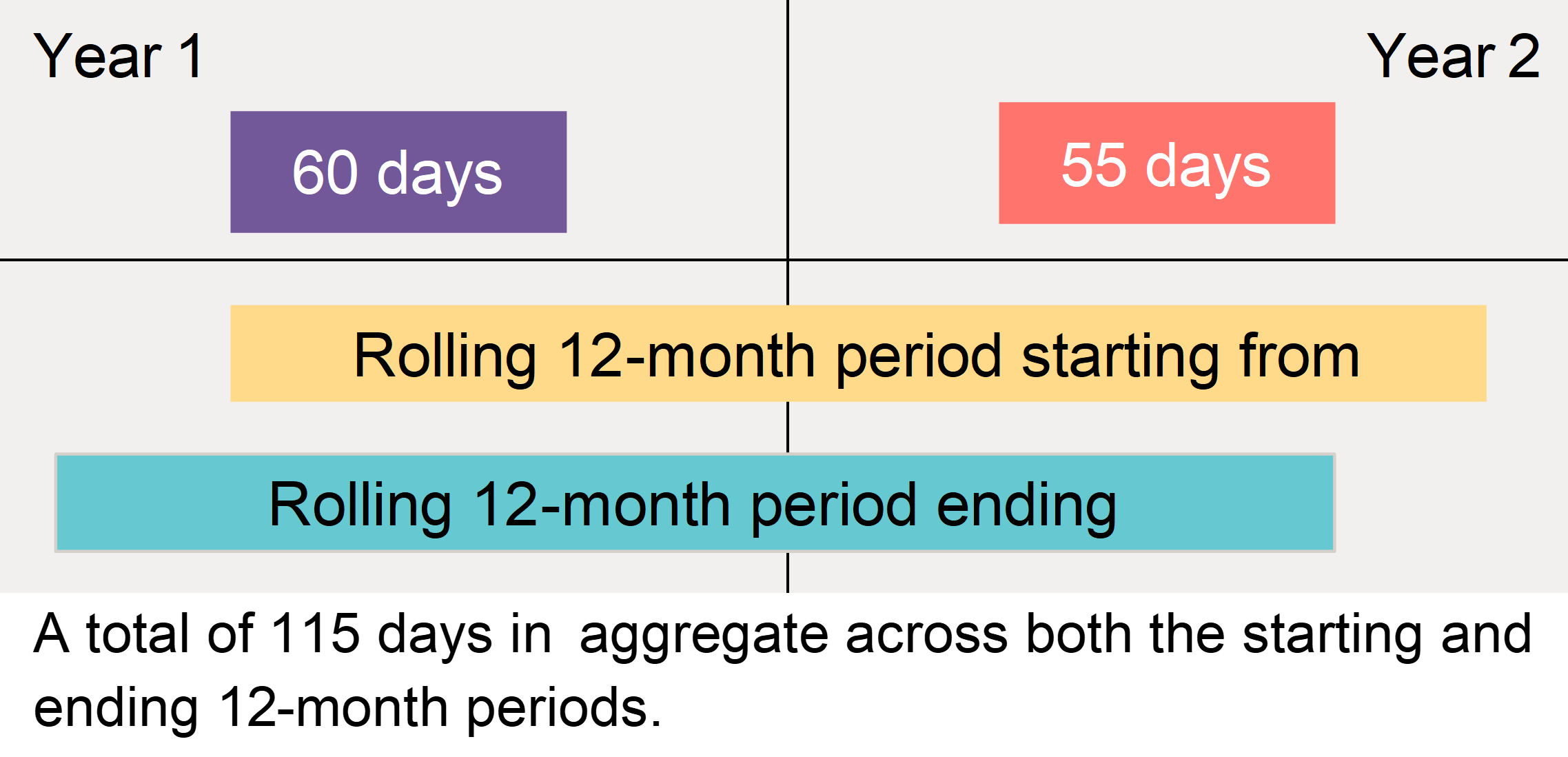

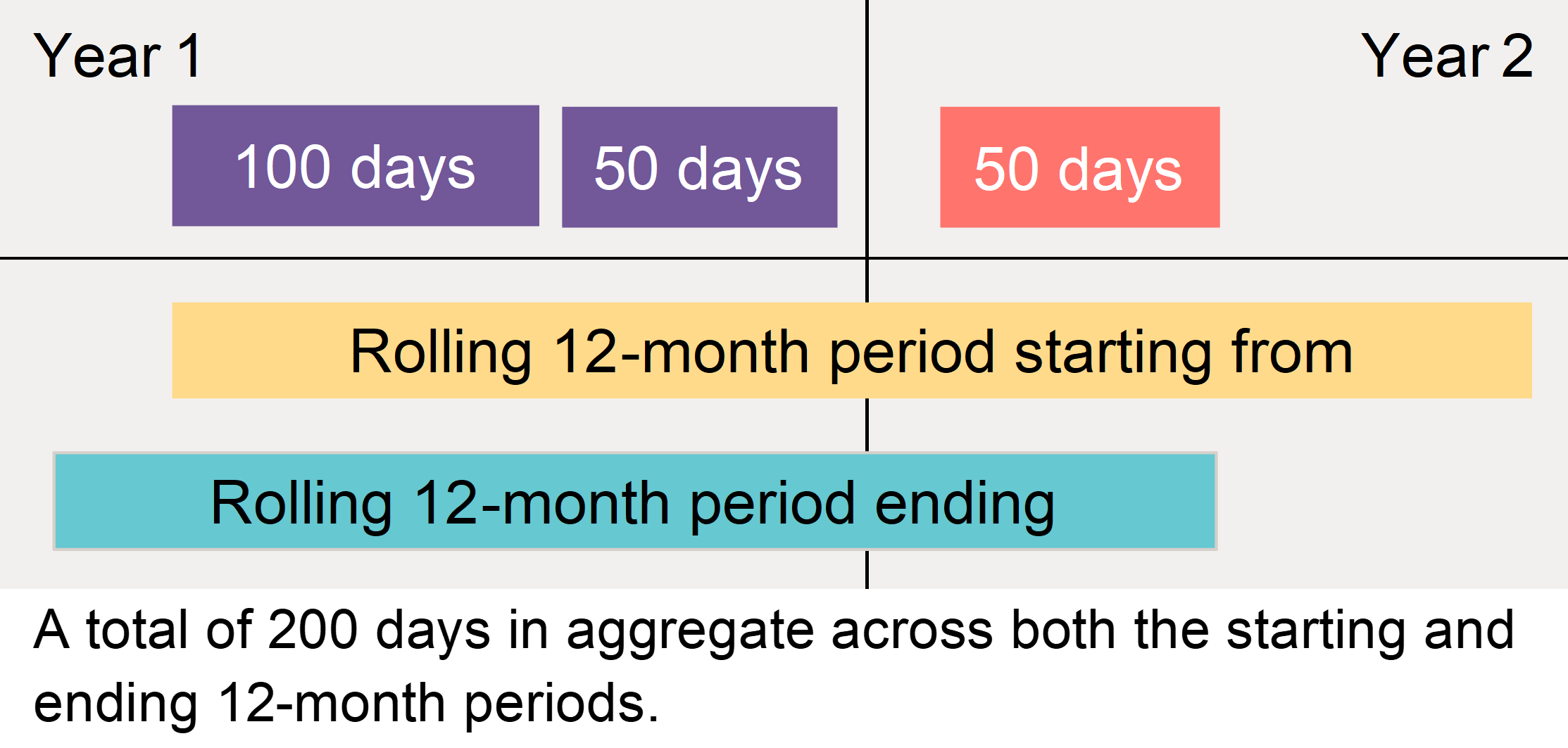

4. Example for rolling 12-month period

An employee of a US company, who is a resident of the US, travels to Japan for the same period of time with the same conditions as the above example. The rolling 12-month period will start and end as follows: The initial 12-month period starts from the date of arrival in Japan. The final 12-month period look-back starts from the last date in Japan.

Since the employee’s total days in Japan during both 12-month periods do not exceed 183 days, the employee meets the 183-day rule.

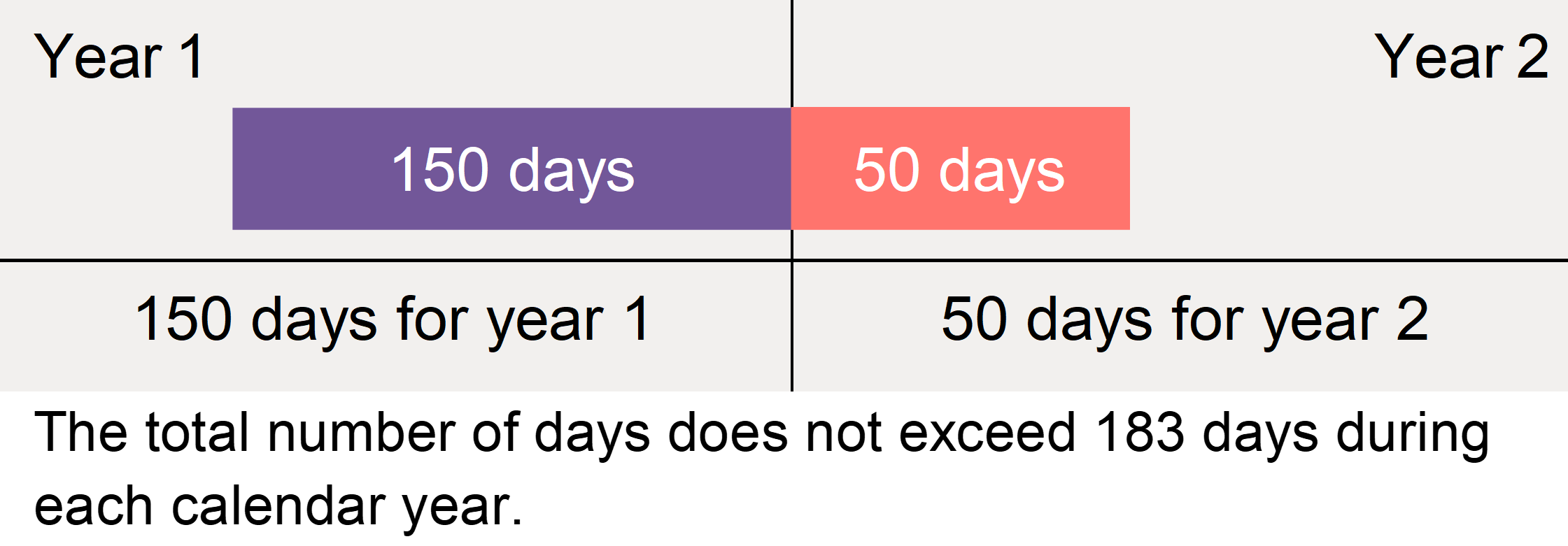

5. What if business travel days cross the year?

Under the below example, an employee spent 150 days during year 1 followed by 50 days in year 2. For the calendar year basis, the employee’s total days in Japan do not exceed 183 days, but for the rolling 12-month period basis, the total days exceeded 183 days and do not meet the 183-day rule.

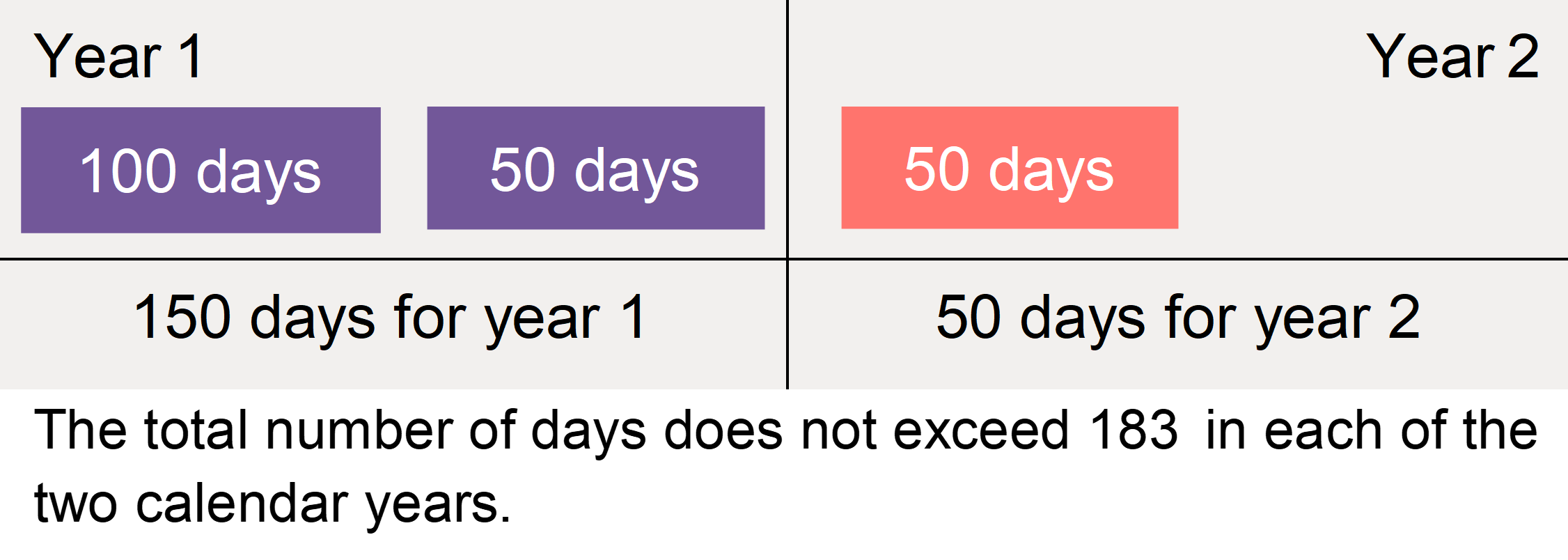

6. What if the 183-day rule is exceeded in the following calendar year?

Under the below example, the employee’s days in Japan do not exceed 183 days for year 1 and year 2 under the calendar year basis.

However, the employee exceeds 183 days after counting year 2 days under the rolling 12-month period basis, making the employee ineligible for treaty relief for both year 1 and year 2 as shown below.

7. Common mistakes in counting days

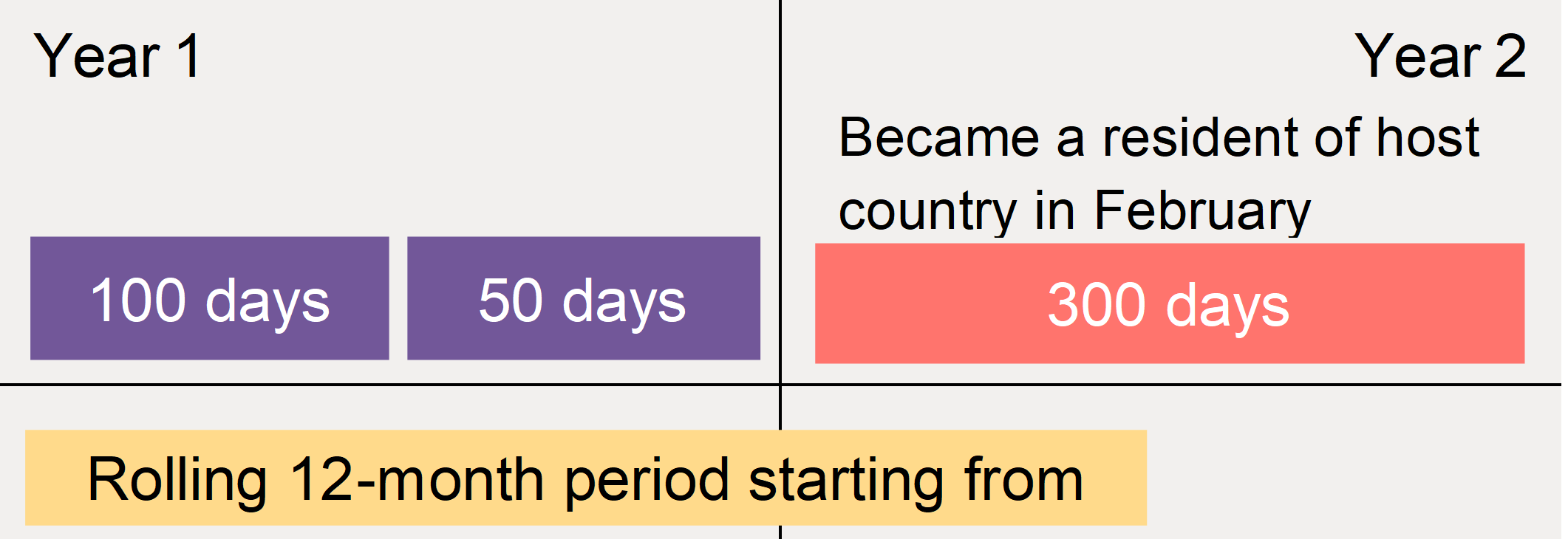

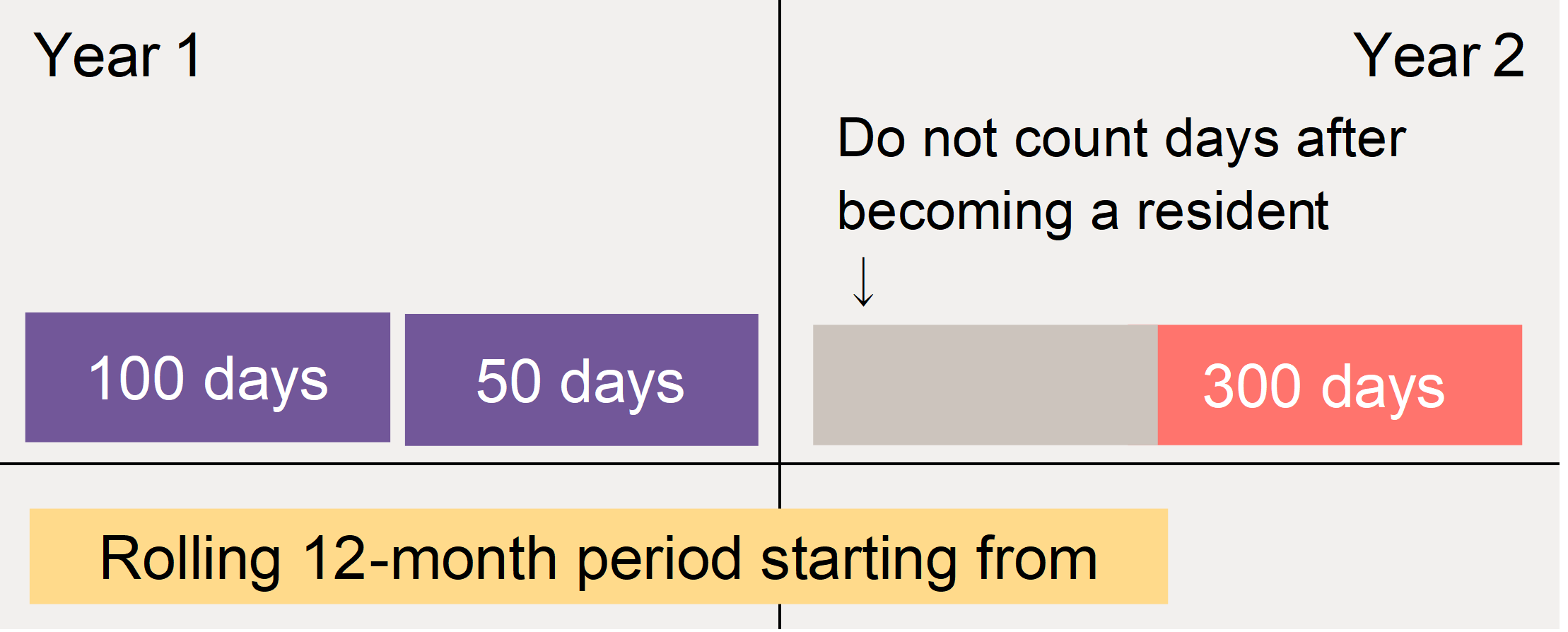

Common mistakes occur when business travel precedes or follows an actual assignment of more than one year as shown below.

The rolling 12-month period basis starts counting days from the first day of arrival in the host country, while the individual is a resident of the home country.

Although pre-assignment business travel days to the host country under the rolling 12-month period basis do not exceed 183 days, if the days after the start date of the year 2 assignment were to be included the day count would exceed 183 days.

However, the treaty convention indicates that the provision of the relief is applicable to remuneration derived by a resident of the home country in respect of an employment exercised in the host country (Japan).

Under the above example, although the total day count exceeds 183 days, the days after becoming resident in the host country (Japan) are not counted [5], thus the 12-month period day count does not exceed 183 days.

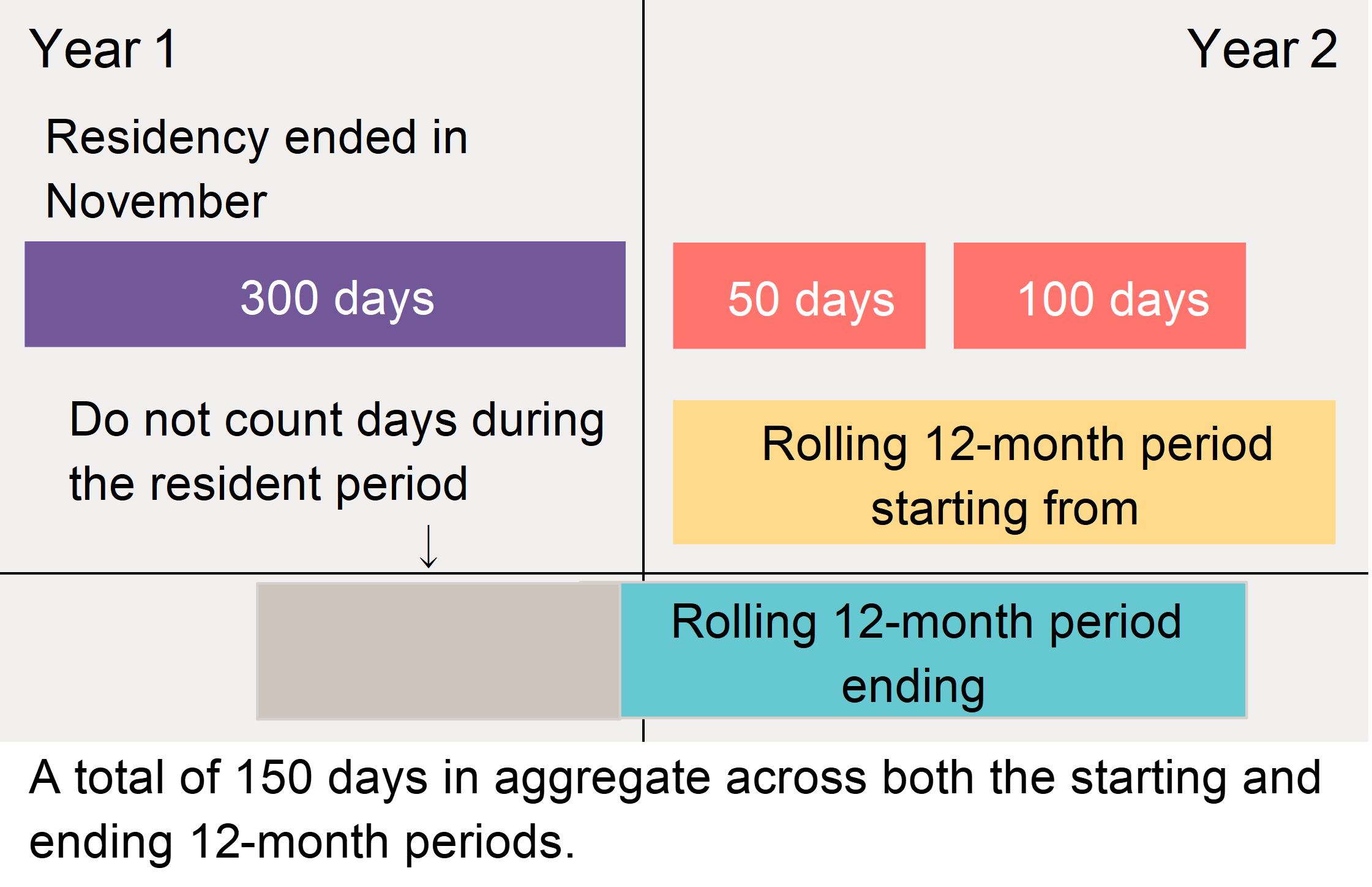

The same concept applies for business travel to the host country (Japan) after becoming a resident of the home country upon repatriation [5]. In the example below, only 150 days are counted and the period when resident in the host country is excluded.

8. Takeaway

When counting days for the 183-day rule in income tax treaties, it is crucial to be aware of the following points to avoid common pitfalls and ensure the travel days to Japan are counted correctly.

1) Understand Counting Methods

Ensure you understand which basis applies to your specific treaty, the calendar year basis for the rolling 12-month period basis.

2) Arrival and Departure Days

Count arrival and departure days, even if you only spend part of the day in Japan.

3) Transit Days

Days spent in Japan in transit are not counted.

4) Travel days before and after an assignment of more than one year

It is not necessary to count days when the employee is tax resident in the host country when looking at the 12-month rolling tests.

5) Treaty Specifics

Not all treaties follow the OECD model exactly. Always check the specifics of the applicable treaty convention.

[1] The treaty between Japan and Thailand adopted 180 days, not 183 days.

[2] Ministry of Finance Japan, “Japan's Tax Treaty Network”, https://www.mof.go.jp/tax_policy/summary/international/tax_convention/250501JP.pdf, (accessed May 28, 2025)

[3] Ministry of Finance Japan, “The List of Japan's Tax Conventions”, https://www.mof.go.jp/english/policy/tax_policy/tax_conventions/tax_convetion_list_en.html, (accessed May 28, 2025)

[4] 川田剛・徳永匡子「2017 OECDモデル条約コメンタリー逐条解説」pp.422-422.

[5] Supra note [4] pp.423-424.

If you are interested in receiving our latest insights, You can sign up to our mailing list.