If you are interested in receiving our latest insights, You can sign up to our mailing list.

相続税の税務調査が拡大

税務当局は、税務調査の重点調査項目として「富裕層」「国際」「無申告」への対応を掲げています。富裕層に対する税務調査が、年々強化されています。

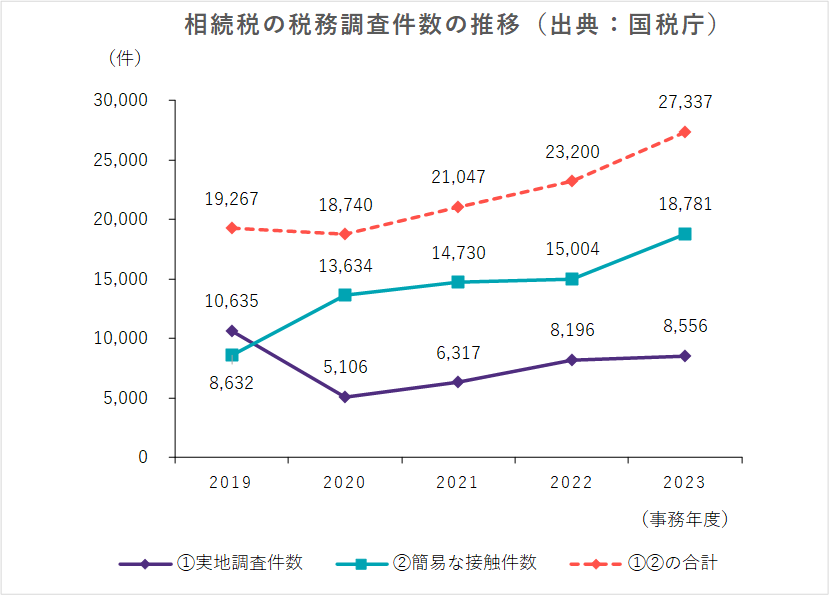

コロナ禍により従来の実地による税務調査は一旦半減しているものの、電話などを活用した「簡易な接触」いわば「ライトな税務調査」は激増しています。また、最近では、AI(人工知能)にデータを学習・分析させて、高度かつ効率的に、税務調査に取り組んでいます。

「実地調査」「簡易な接触」を合わせた税務調査の件数は、パンデミックを挟み、2019年:19,267件から、2023年:27,337件にV字回復プラスさらに激増してきています。

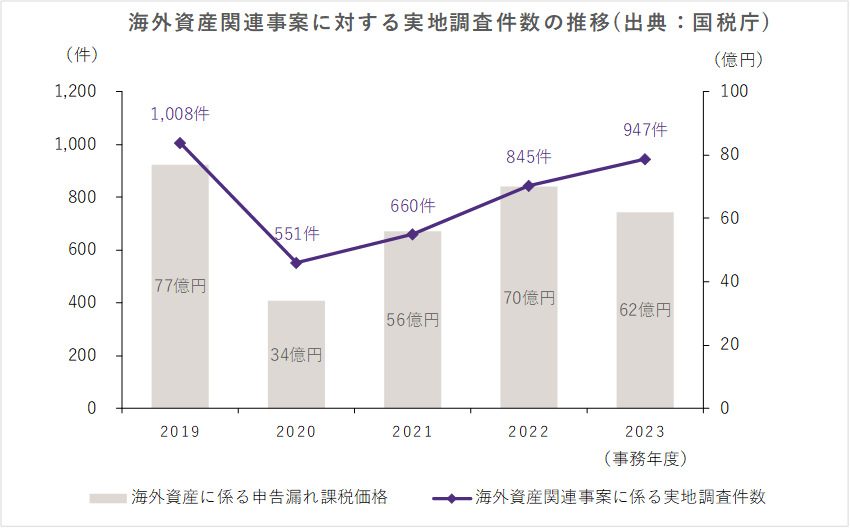

くわえて、海外資産に関連する実地調査についても高水準で推移しています。

海外取引・財産情報をキャッチ

税務当局は、納税者や金融機関に3種類の法定調書・レポートを提出させることで、海外取引や国内外の財産の情報を漏れなく捕捉しています。

1. 国外送金等調書

100万円を超える日本国内へおよび国外へ送金する都度、金融機関が税務当局へ提出することが義務付けられています。

2.国外財産調書

年末において日本国外に5,000万円を超える財産を保有する日本居住者は、国外財産調書を提出しなければなりません。

3.財産債務調書

総所得金額が2,000万円を超え、かつ、年末ベースで国内外に3億円以上(または1億円以上の有価証券)の財産の保有者は、財産債務調書の提出が必要です。日本で確定申告の義務がある非居住者も、この条件に該当する場合には、提出が必要になります。

さらに2023年分から、所得がなくても年末に10億円以上の財産を保有する日本居住者も、新たに提出義務が課されました。

外国の税務当局とも情報交換

3種類の法定調書のほかに、国税庁は、CRS情報(共通報告基準に基づく非居住者金融口座情報)をはじめとした租税条約などの規定により、積極的に外国税務当局との情報交換を進めています。あらたに2027年からは、日本・シンガポールも参加する「暗号資産報告フレームワーク(CARF)」による情報交換もスタート予定です。富裕層の海外取引による資産隠しや、税負担を軽減する国際的な租税回避に目を光らせています。

国際資産税には、事前準備が重要

パンデミック後、ビジネスモデル・家族形態・働き方・資産ロケーションがますます複雑化・多様化しています。税務当局による情報捕捉が進む一方、これらの「変化」に税法の解釈が追いついていないグレーゾーンのケースも多いのが現状です。

居住性(含双方居住)・納税義務の判断、フローの所得の課税範囲、ストックの譲渡・贈与・相続にかかる税務など・・・多面的な観点で税務上の課題・問題点の有無について、各国の税務専門家への相談・セカンドオピニオンによる確認などの事前準備の対応をお勧めします。