-

Business Tax Services

Growing businesses need strong tax management to meet current and future tax liabilities and we can help you achieve this, whatever challenges you face.

-

Private Client Consulting

Private Client Consulting team provides a comprehensive cross section of advisory services to high net worth individuals and corporate executives, allowing such individuals to concentrate on their business interests.

-

International Tax Services

In an ever-increasing environment of global competition, businesses must now cope with not only the complexity of different global operating environments, but also with global tax, legislative and corporate regulatory requirements.

-

Transaction Tax

We provide total support from the early due diligence stage right through to implementation of the post-transaction structure, considering not only the tax impact but also assisting with business valuations and planning the business restructuring.

-

Corporate Finance

Our business consulting services can help you improve your operational performance and productivity, adding value throughout your growth life cycle.

-

IPO Consulting

From business incubation to public stock offering, Grant Thornton Taiyo Inc. offers a wide range of support programsservices for every stage of business development.

-

International financial reporting standards (IFRS)

Our IFRS advisers can help you navigate the complexity of the Standards so you can focus your time and effort on running your business.

-

Reorganizations

Grant Thornton Taiyo Inc. provides total support for corporate restructuring; aimed atto responding to dramatic changes in the management environment.

-

Corporate governance and risk management

We can support you throughout the transaction process – helping achieve the best possible outcome at the point of the transaction and in the longer term.

-

Forensic and investigation services

We can support you throughout the transaction process – helping achieve the best possible outcome at the point of the transaction and in the longer term.

-

Market research

We can support you throughout the transaction process – helping achieve the best possible outcome at the point of the transaction and in the longer term.

-

Strategy

We can support you throughout the transaction process – helping achieve the best possible outcome at the point of the transaction and in the longer term.

-

China Business and Tax Advisory Services

Grant Thornton Taiyo Tax Corporation takes the worry out of doing business in China, working closely with Grant Thornton member firms and other professional accounting firms in China.

-

Human Capital

With expertise visa, payroll, human capital and income tax, Grant Thornton Taiyo Human Capital Corporation adopts a multi-disciplinary and global approach to provide comprehensive solutions to businesses with respect to their most valuable asset, people.

-

Business Process Re-engineering

“Business improvement” aims to gradually increase efficiency through a reduction in errors and improvement in the quality of work.

-

Forensic and investigation services

We can support you throughout the transaction process – helping achieve the best possible outcome at the point of the transaction and in the longer term.

-

International financial reporting standards (IFRS)

Our IFRS advisers can help you navigate the complexity of the Standards so you can focus your time and effort on running your business.

Services

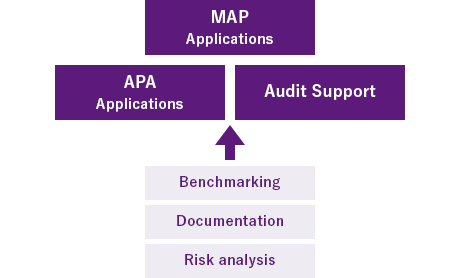

Japan's transfer pricing regulations put the onus on taxpayers to demonstrate that prices of all related party transactions are compliant with the arm’s length principle. Taxpayers should have transfer pricing policies and supporting documentation to reduce audit risk.

How can Grant Thornton Taiyo Tax Corporation help you?

Our transfer pricing advisory team can assist you with all aspects of implementing and managing a Japan-compliant transfer pricing policy, including:

- Risk analysis – identify transfer pricing risks through an economic analysis of your business;

- Documentation – prepare transfer pricing documentation or review existing documentation to ensure Japan compliance;

- Benchmarking – provide industry-specific benchmarking studies against Japan or international companies;

- Audit support – plan or review audit counter-measures, attend on-site audits, and assist in negotiations with NTA examiners;

- APA applications – facilitate and assist the APA application process from initial planning and document preparation through final settlement;

- MAP applications – facilitate and assist the MAP application process from preliminary meetings through mutual consultation requests, negotiation, and settlement.

Seminars / Consultations

Grant Thornton Taiyo Tax Corporation periodically holds seminars providing practical information on transfer pricing issues faced by clients. Attending a seminar is free and presents an opportunity for consultation with our tax professionals. For more information about attending a seminar, please contact us.

Risk Assessment, Documentation and Benchmarking

Grant Thornton Japan can provide cost effective transfer pricing risk assessment and planning, TP documentation and benchmarking analysis. Our services include:

- An industry wide comparability analysis.

- Reviewing key related-party transactions and current transfer pricing policy.

- Identifying transactions with material transfer pricing risk based on current financial performance.

- Advising on cost-effective solutions to mitigate transfer pricing risk.

- Flexible scope and depth of assessment depending on client needs.

- Function and risk analysis;

- Economic analysis and comparable search using leading a commercial database;

- Determination of an arm’s length range.

Audit Support

For companies facing a transfer pricing audit, Grant Thornton Taiyo Tax Corporation’s transfer pricing team can assist with:

- Early identification of high risk target transactions

- Quantifying potential assessments

- Devising appropriate countermeasures and defense strategies

- Participation at on-site audits

- Negotiating assessments and other issues

Advanced Pricing Agreement (“APA”) Application

Grant Thornton Taiyo Tax Corporation provides support throughout the APA process including:

- Initial planning

- Establish the transfer pricing position for the APA

- Preparation of the application package

- Support at pre-filing meetings

- Negotiation with the tax authority

- Manage communications with APA reviewers

- Advise and support taxpayer through final settlement of the APA

- Preparation of annual compliance reports during the APA period

Mutual Agreement Procedure (MAP) Applications

Grant Thornton Japan’s provides support services for mutual agreement procedures including::

- Support at pre-filing meetings

- Preparation of initial MAP request documents

- Preparation of supporting documentation and analysis on transactions in question

- Negotiations with competent authorities

- Advice and support through negotiations and settlement with competent authorities.